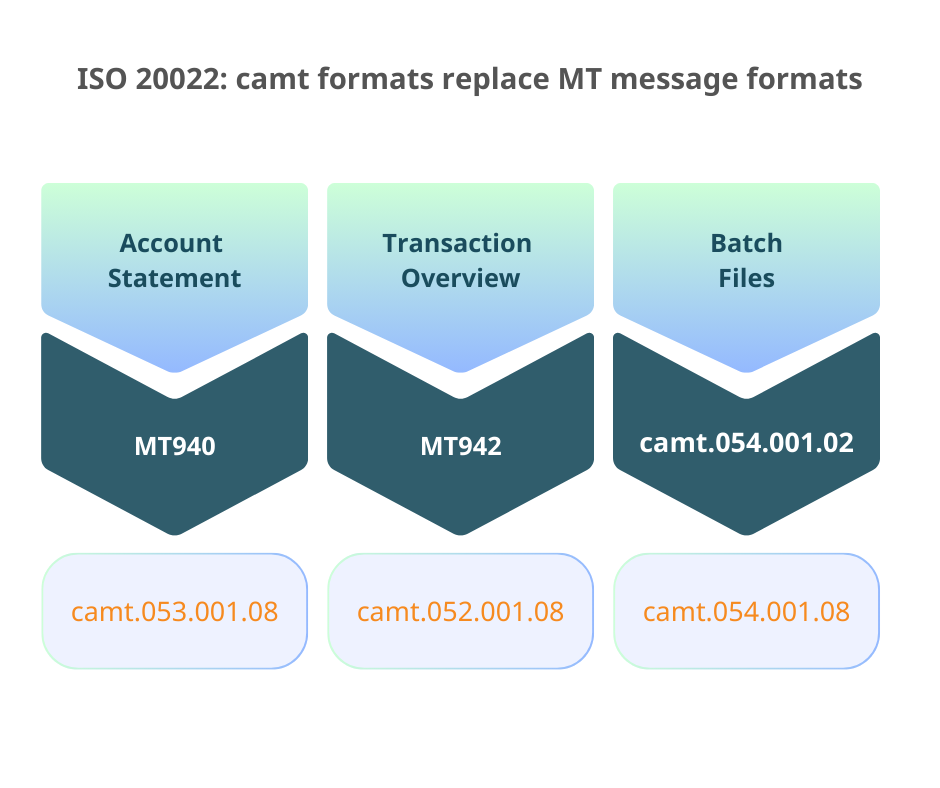

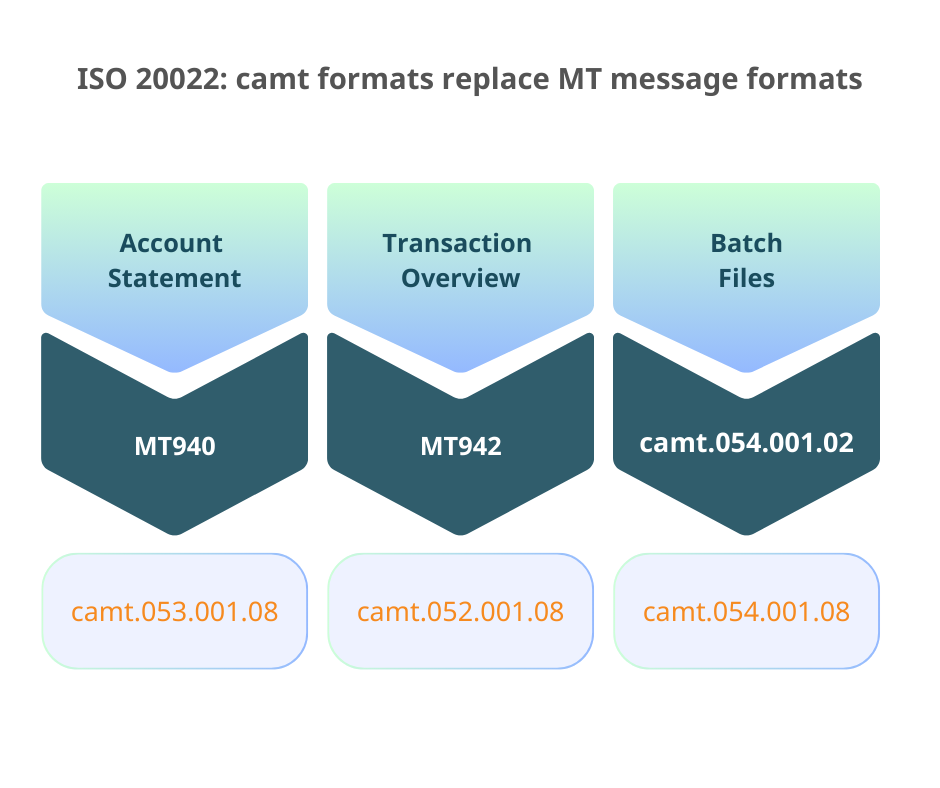

The introduction of the new camt.053 and camt.052 formats brings significant advantages for processing and analyzing your payment data, yet it also requires adjustments to your current systems and processes. Built on the ISO 20022 framework, these XML-based formats replace the older MT940 (daily statement) and MT942 (intraday movements) formats.

They offer a standardized, harmonized way to present payment data, enhancing flexibility, accuracy, and transparency in communicating your account transactions.

Details that were once included in remittance information, such as payment partners' addresses or ISO descriptions of payment methods, will now be delivered through separate fields. Additionally, the new formats provide more detailed information about your postings, previously constrained by space limitations. For instance, camt messages now include text for account statement postings or fee settlements in a format akin to paper or PDF account statements.

If you’ve already adopted camt.053, version 02, you’ve made significant progress. However, further changes are required to upgrade to version 08.

The structured addresses and detailed information will improve your ability to conduct embargo, sanction, and fraud checks, thereby enhancing the security and compliance of your payment operations. Enhanced details on payment methods, partners, and remittance information will enable more effective allocation of payments within treasury or financial accounting, leading to better liquidity management and reporting.

Furthermore, the new formats allow the repetition of the Remittance Information field, simplifying the matching of aggregated payments.

ConnectIQ is the solution you are looking for! Our all-in-one platform is designed to streamline and accelerate the migration to the ISO 20022 standard, offering a seamless path to adoption.

A key benefit of ConnectIQ is its capability to natively support both SWIFT MT and MX formats. This feature is especially valuable during the transition, as it helps manage the complexities of integrating new standards while ensuring continuity with existing processes.

With ConnectIQ, you can make your migration to camt.053 (Version 8) efficient, effective, and minimally disruptive, giving you the confidence to manage your payment data transition smoothly.

Adapting to camt.053 and camt.052: Key Changes and Considerations

Transitioning to these new formats involves several notable changes. The structure and content of messages, particularly regarding remittance information, will be different, necessitating customization of your existing mapping elements for downstream processing to accommodate the new data fields.Details that were once included in remittance information, such as payment partners' addresses or ISO descriptions of payment methods, will now be delivered through separate fields. Additionally, the new formats provide more detailed information about your postings, previously constrained by space limitations. For instance, camt messages now include text for account statement postings or fee settlements in a format akin to paper or PDF account statements.

If you’ve already adopted camt.053, version 02, you’ve made significant progress. However, further changes are required to upgrade to version 08.

Why the Switch Is Essential

Switching to the new formats is mandatory and should be completed promptly. The new formats offer a range of benefits that can greatly enhance your business processes. You’ll benefit from agreeing on tags and field assignments for internal payment flows, facilitating easier and faster exchange and processing of payment information.The structured addresses and detailed information will improve your ability to conduct embargo, sanction, and fraud checks, thereby enhancing the security and compliance of your payment operations. Enhanced details on payment methods, partners, and remittance information will enable more effective allocation of payments within treasury or financial accounting, leading to better liquidity management and reporting.

Furthermore, the new formats allow the repetition of the Remittance Information field, simplifying the matching of aggregated payments.

Is your switch to camt.053 (Version 8) on track?

As banks and financial institutions transition to the camt.053 (Version 8) format, managing the migration of payment data is crucial for maintaining efficiency and accuracy.ConnectIQ is the solution you are looking for! Our all-in-one platform is designed to streamline and accelerate the migration to the ISO 20022 standard, offering a seamless path to adoption.

A key benefit of ConnectIQ is its capability to natively support both SWIFT MT and MX formats. This feature is especially valuable during the transition, as it helps manage the complexities of integrating new standards while ensuring continuity with existing processes.

With ConnectIQ, you can make your migration to camt.053 (Version 8) efficient, effective, and minimally disruptive, giving you the confidence to manage your payment data transition smoothly.

Tagged under

Related items

- The real-time payment reality : Future-Proofing Payment Data Monetization

- Modernizing Reconciliation and Investigation for Payment operations

- Transforming Payment Reconciliations and Investigations for improved operational efficiency

- 2023's Top Banking Software Glitches Exposed

- Breaking Free: Why It's Time to Ditch Manual Spreadsheets for Reconciliation