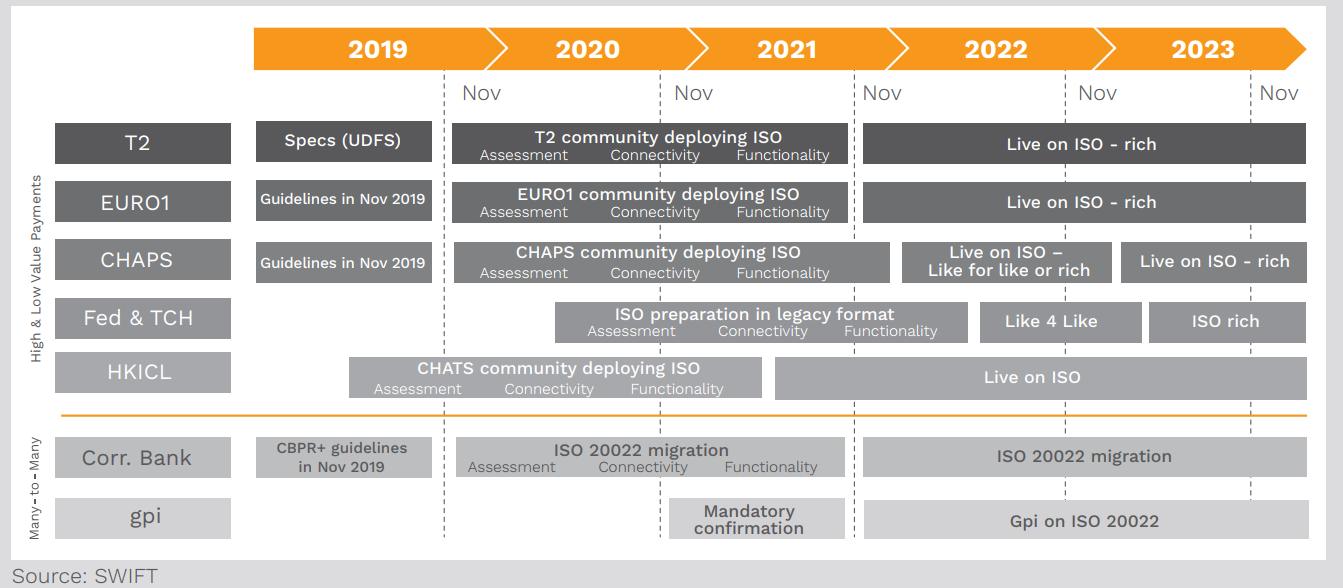

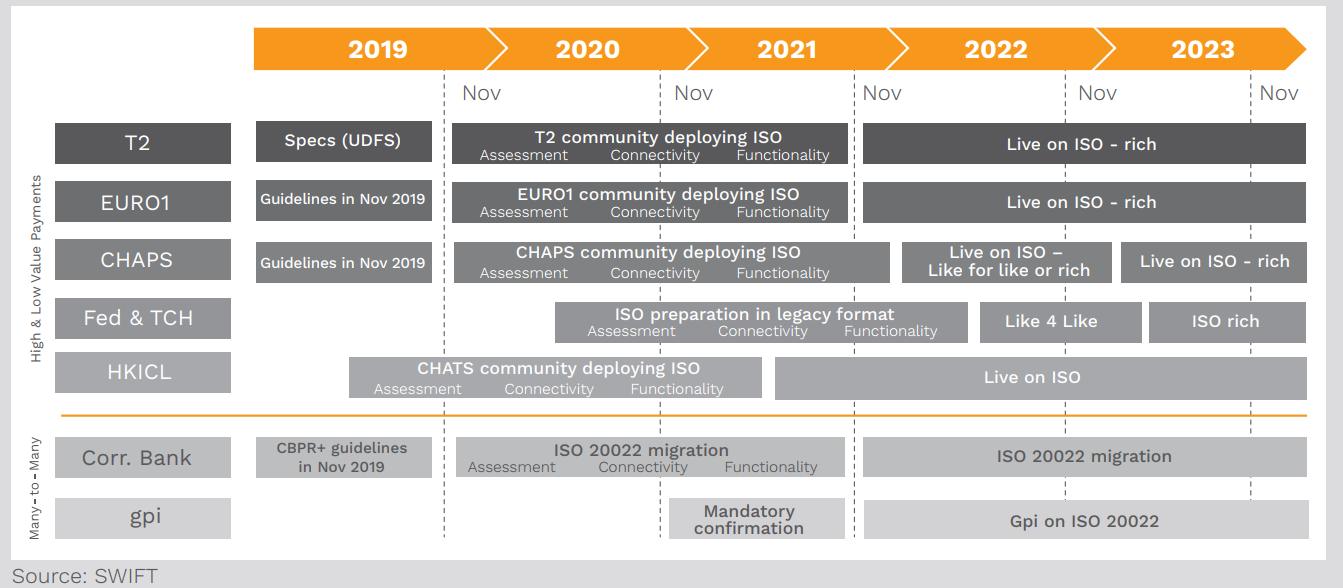

The race to adopt ISO 20022 for Swift cross-border payments and reporting messages has started and must be completed by November 2025.

ISO 20022 can act as a catalyst for transformation, both in terms of strategy and underlying technology.

ISO 20022 not only defines the syntax or format of a message but also provides a common vocabulary and consistent terminology for use, no matter where a business is based. It carries many additional data fields, in an improved data structure, with an array of new metadata.

As an example, the Federation of Finnish Financial Services has established ISO 20022 Tax Report messages, facilitating the transmission of VAT data to tax authorities. These messages, derived from electronic invoices using ISO 20022, not only streamline tax reporting but also contribute to combating the grey economy. For instance, the construction sector employs a standardized identifier on ISO 20022 electronic invoices, enabling automatic compilation and reporting of contract prices, as specified in agreements, for tax purposes.

ISO20022 is at the core of nearly all banking modernization and transformation programs:

The Swedish bank SEB is an example. They facilitate both Consumer-to-Business (C2B) and Business-to-Consumer (B2C) channels using ISO 20022. SEB actively promotes the utilization of its online banking tool with manual ISO 20022 file uploads for smaller corporations with lower transaction volumes.

Along with financial institutions, large corporates, like Ikea, and the German Postal Service worldwide are also looking to establish best practices for leveraging ISO 20022 in the corporate sector. Data analytics is becoming progressively crucial for banks to differentiate themselves, enhance efficiency and drive revenue growth by generating added value for their corporate customers.

Many banks already struggle to process the data they already have at speed, before we even consider the potential increase in requirements that ISO 20022 brings. Data must be securely stored and available on a near real-time basis for queries and auditing.

The implementation will definitely be challenging, for example, the implementation of the ISO Bank to Customer Cash Management message (Camt) can vary based on the underlying infrastructure provider, whether it be SWIFT, SEPA, Target2, SIX Chaps or RTGS.

Banks will require to have a clear migration strategy before they start mapping between formats. Most of them are likely to deploy translation services to map existing message formats to and from ISO 20022. However, this is not a long-term solution as they will lose the extended data carrying capabilities and data intelligence from implementing ISO 20022.

ISO 20022 serves a dual purpose, functioning as both an interbank data standard and facilitating the essential data standardization needed for API development. This means that banks can depend on a single data standard to meet all their payment needs, while market infrastructures can adopt one data standard for multiple payment systems.

Leveraging ready-built SWIFT MT <> ISO 20022 mapping library reduces the risk, time and cost of an in-house implementation, allowing clients to start with a full set of high-quality SWIFT MT <> ISO 20022 mappings that are easily customizable. It is able to match new MX messages under ISO 20022 standards, with your internal records, identify discrepancies and exceptions, generate reports and alerts, and comply with regulatory requirements. Contact us to find out how you can simplify your ISO 20022 migration, reconciliation and testing in less than a month!

What is ISO20022?

ISO 20022 is essentially the roadmap to create consistency in global financial markets and banks have committed to using the format in both the payments and settlement domains. It was developed to facilitate electronic data interchange between financial institutions.ISO 20022 not only defines the syntax or format of a message but also provides a common vocabulary and consistent terminology for use, no matter where a business is based. It carries many additional data fields, in an improved data structure, with an array of new metadata.

Benefits of ISO 20022

Adopting this international standard enables companies to reach out to more customers, in more locations, with less concern for national boundaries and local legacy standards, promoting at the same time more automation, fewer technical errors, ease of implementation, openness and cost-efficiency for those who embrace it.- A diverse user community indicates the availability of numerous technical solutions that can be acquired and implemented with at a lower cost and a faster time to market.

- Increased interoperability between markets and currencies

- Improved processing time and greater accuracy, for example, in Financial Crime checks

- Reduced complexity, cost and risk of data transformation and manipulation

- More information on payment types, as well as more information on senders and receivers enables banks to better understand their customer’s behaviors but also trends across different sectors or geographies, enabling them to get real value from data at speed.

As an example, the Federation of Finnish Financial Services has established ISO 20022 Tax Report messages, facilitating the transmission of VAT data to tax authorities. These messages, derived from electronic invoices using ISO 20022, not only streamline tax reporting but also contribute to combating the grey economy. For instance, the construction sector employs a standardized identifier on ISO 20022 electronic invoices, enabling automatic compilation and reporting of contract prices, as specified in agreements, for tax purposes.

ISO20022 is at the core of nearly all banking modernization and transformation programs:

Data is the link between banks and corporates

Companies, especially in Central and Northern Europe, are well-acquainted with utilizing and handling ISO 20022 messages. In Switzerland, a mandate from 2018 required corporates to use ISO 20022 payment initiation messages. Additionally, banks need to guarantee the provision of end-of-day account statements to their corporate customers in accordance with ISO 20022.The Swedish bank SEB is an example. They facilitate both Consumer-to-Business (C2B) and Business-to-Consumer (B2C) channels using ISO 20022. SEB actively promotes the utilization of its online banking tool with manual ISO 20022 file uploads for smaller corporations with lower transaction volumes.

Along with financial institutions, large corporates, like Ikea, and the German Postal Service worldwide are also looking to establish best practices for leveraging ISO 20022 in the corporate sector. Data analytics is becoming progressively crucial for banks to differentiate themselves, enhance efficiency and drive revenue growth by generating added value for their corporate customers.

Navigating the Challenges of Implementing ISO 20022

Al financial institutions will need to be able to support both ISO 20022 messages as well as the old standards like SWIFT MT, and integrate it with the various message types which may be proprietary or standards-based (ISO 15022, FpML, FIX, etc), ensuring interoperability between different systems and regions.Many banks already struggle to process the data they already have at speed, before we even consider the potential increase in requirements that ISO 20022 brings. Data must be securely stored and available on a near real-time basis for queries and auditing.

The implementation will definitely be challenging, for example, the implementation of the ISO Bank to Customer Cash Management message (Camt) can vary based on the underlying infrastructure provider, whether it be SWIFT, SEPA, Target2, SIX Chaps or RTGS.

Banks will require to have a clear migration strategy before they start mapping between formats. Most of them are likely to deploy translation services to map existing message formats to and from ISO 20022. However, this is not a long-term solution as they will lose the extended data carrying capabilities and data intelligence from implementing ISO 20022.

ISO 20022 serves a dual purpose, functioning as both an interbank data standard and facilitating the essential data standardization needed for API development. This means that banks can depend on a single data standard to meet all their payment needs, while market infrastructures can adopt one data standard for multiple payment systems.

Simplifying and De-risking the Migration process

Validata can support banks and financial institutions for the migration and coexistence of SWIFT MT and MX formats, by providing an all-in-one, no-code ‘super app’ for real-time legacy migrations, AI-powered end-to-end reconciliation and exception management and end-to-end automated testing that seamlessly integrates with the demands of the new standard.Leveraging ready-built SWIFT MT <> ISO 20022 mapping library reduces the risk, time and cost of an in-house implementation, allowing clients to start with a full set of high-quality SWIFT MT <> ISO 20022 mappings that are easily customizable. It is able to match new MX messages under ISO 20022 standards, with your internal records, identify discrepancies and exceptions, generate reports and alerts, and comply with regulatory requirements. Contact us to find out how you can simplify your ISO 20022 migration, reconciliation and testing in less than a month!