Risk-Based Testing Methodology

Risk-Based Testing is a strategic approach to software testing where testing efforts are prioritized based on the level of risk associated with different components of the application. Instead of evenly distributing testing resources across all functionalities, it focuses on the areas that pose the highest risk to business operations, security, performance, and compliance.

Challenge

Testing teams often face the same issue—too many tests with minimal application coverage. Teams frequently create duplicate, redundant test cases that don’t add any value, leading to increased maintenance efforts and an ever-expanding test suite.

This approach is inefficient and costly. In addition, it leaves blind spots behind, leaving up to 35% of the functionality untested. Most companies attempt to cover their top risks intuitively, and this results in an average business risk coverage of 40%.

By identifying and ranking risks early in the development cycle, this approach ensures that critical issues are addressed proactively, reducing the chances of failure in production.

By using our risk-based testing methodology, alongside our ‘built for change’ technology and best practices, we empower our customers to accelerate their digital transformation and deliver optimal customer experience.

De-risk your releases and improve quality

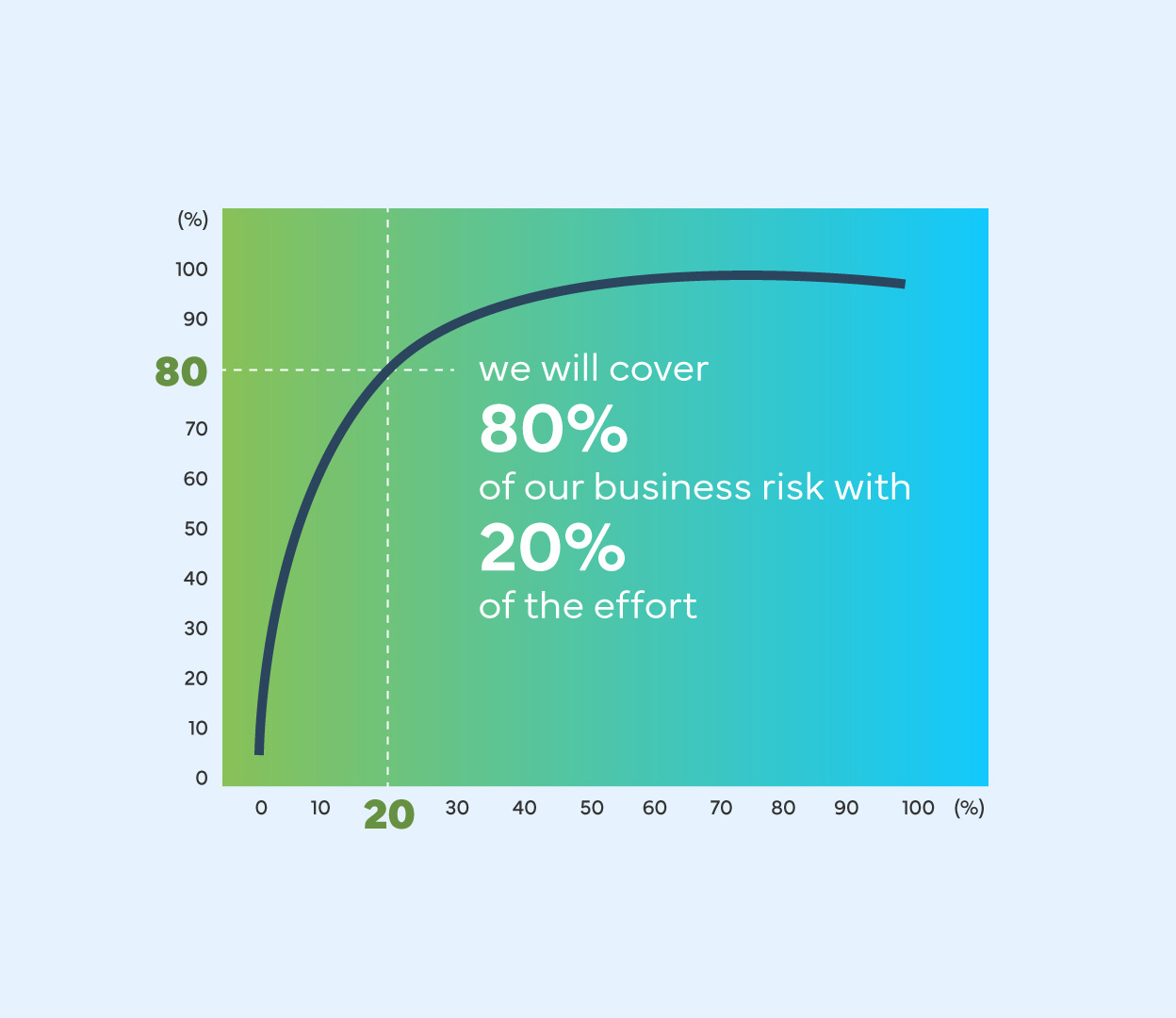

Leveraging the 80:20 rule, we enable testing teams focus their efforts on the most problematic areas of the application, maximizing test coverage and impact with minimal effort.

Our approach to testing ensures that operational and business risks are identified and prioritized to ensure the issues are fully addressed. By adjusting the testing effort to accommodate the emerging risks, it helps to maintain control and mitigate the major business risks.

Proven ROI

Test more with less effort!

Our approach accounts for reduced cycle times, reduced resource requirements per cycle and reduced maintenance of test packs. Finding and Fixing defects is much faster and easier. You can now ensure that you are testing the right things and have higher quality software releases.

Benefits

By focusing on high-risk components, teams can detect and resolve critical defects early in the software development lifecycle, preventing costly fixes later.

Ensure that the most vulnerable and business-critical functionalities receive thorough testing, leading to a more reliable and secure application.

Eliminate unnecessary testing efforts, accelerate the testing process, allowing businesses to launch products faster without compromising quality.

By continuously assessing and adapting to new risks, you gain better control over software reliability, and make better decisions over your releases, reducing the likelihood of failures post-deployment.