Defect Intelligence

Preventing defects from occurring requires a structured disciplined methodology; including

gathering and analysing data and conducting root cause analysis, determining and implementing the

corrective actions and sharing the lessons learned between projects to avoid future defects. The impact of fixing defects as early as possible can make a massive difference to your project costs.

The cost of a defect found during the design phase is $70, whereas it increases to $1,050 if found in QA phase and $7,000 when found in production.

The cost of doing nothing can be astronomical and damaging to your digital performance.

Challenges

- Lack of clear problem definition and effective communication between QA and DevOps teams.

- Defect categorization based on intuition and wrong assumptions.

- Takes a lot of time and effort to identify the root cause of a defect.

- Reactive rather than proactive defect management, resulting in higher costs and longer resolution times.

- Dependency on manual defect identification and analysis, leading to inconsistencies, delays, and increased project risk.

Turn your data into a powerful prediction model that saves time, resources, and cost

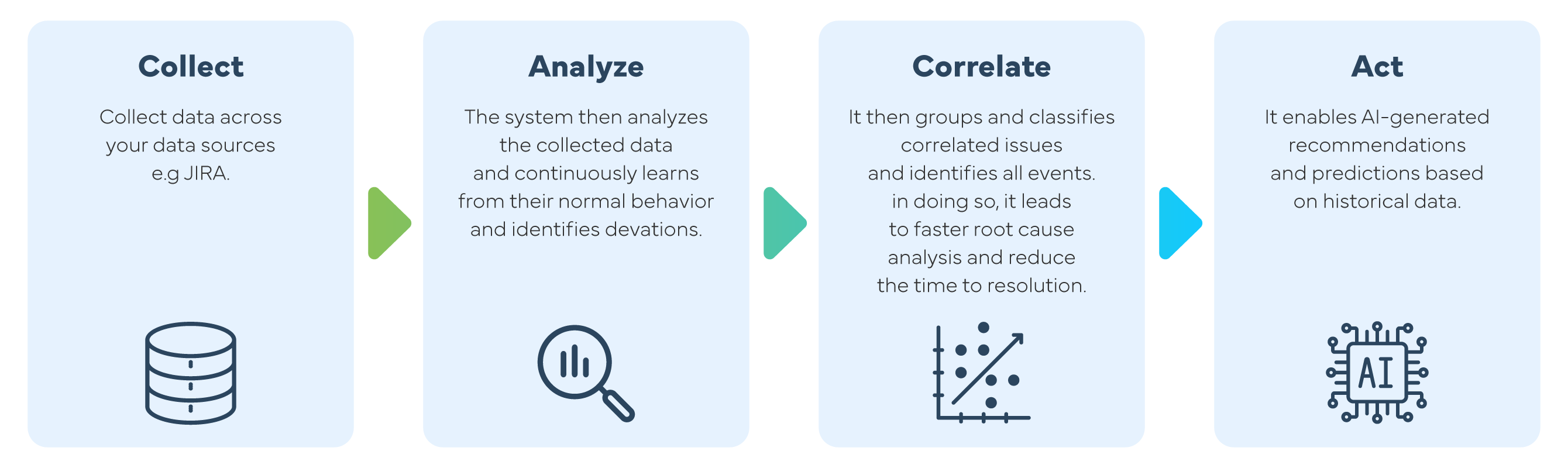

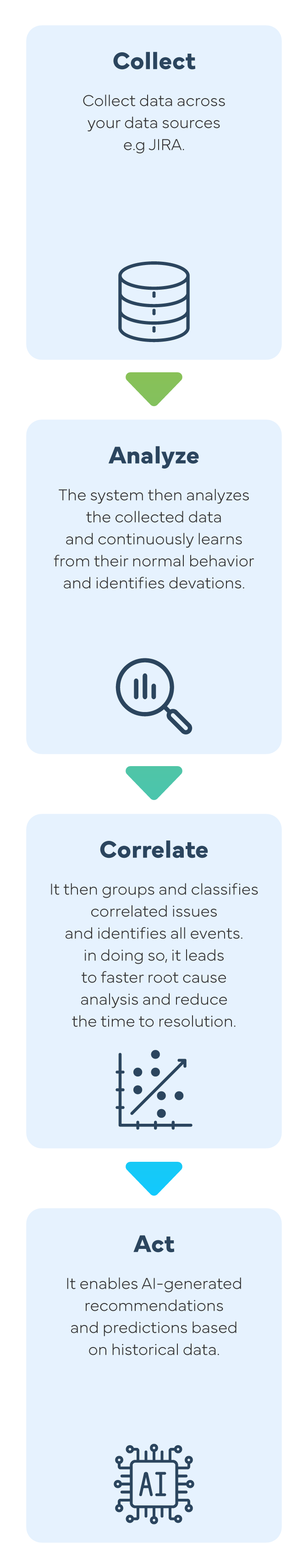

Validata has fully automated the defect prediction and analysis process, leveraging machine learning algorithms and AI techniques to predict defects in real-time and determine the ‘next best action’.

The AI engine, Annie, is also able to predict where defects are most likely to occur and correlate data to quickly identify and resolve them. By forecasting each week’s bugs, it brings efficiencies in planning and resourcing, corrects the release policy and helps your development teams fix issues faster!

Automatic creation of defects

Once a workflow step has failed due to a bug, the system is able to automatically create the defect from the failed step, monitor it and once it is fixed, it will automatically rerun the test case.

Automated defect root cause analysis

Identifying the root cause of defects manually requires significant effort, often involving multiple teams and extended debugging sessions. Poorly documented defect description reports can lack crucial details, leading to misinterpretation, wasted debugging time, and repeated investigations.

The longer it takes to identify and fix a bug, the greater the impact on project timelines, operational costs, and customer satisfaction.

By leveraging explainable AI and advanced algorithms, the platform performs automated root cause analysis eliminating guesswork by accurately identifying the underlying causes of defects. It analyses the data to identify patterns, correlations, and potential root causes. This involves comparing the defect data with historical data to find similarities and anomalies, and justifies the results, reducing human error and leading to faster times to detect, investigate and resolve issues.

Defects Classification

It provides real-time classification on the root cause of the defects based on existing defect patterns and trends. In doing so, it results in quickly routing the defect to the right person or team for fixing.

This helps to identify any regressions as soon as possible, to accelerate development, and to drive higher quality and productivity for your projects.

It also provides insightful recommendations on which developer in terms of skillset, experience and realistic ‘time to fix’ insights based on historical data & trends would be the best one to be assigned the issue. This allows informed decisions to be made with regard to prioritisation and acceleration of fixes, resulting in de-risking the project.

Faster ‘Time-to-fix’

Realistic ‘time to fix’ insights based on historical data & trends. This allows informed decisions to be made with regards to prioritisation and acceleration of fixes, resulting in the de-risking of the project.

Defect Replay: real-time status analytics

It automatically creates the “defect replay” status report , based on the users’ filtering, illustrating the traffic and volume of defects processed for the given period.

Benefits

Because it is able to predict the testing metrics, it enables the Project manager to change the release decision when he knows that the defect can be fixed within a shorter time period.

Detecting and resolving defects earlier in the development lifecycle significantly lowers the cost of fixing defects, reducing overall project expenses.

Improves communication between QA, DevOps, and development teams by providing clear defect categorization and prioritization, ensuring seamless resolution.

Enables early detection of regressions and accelerates development, improving software quality and reducing the risk of production failures.

Provides insights on which developer, based on skillset and experience, is best suited to resolve specific defects, streamlining the fixing process.

Helps teams make informed decisions on prioritization and acceleration of fixes, minimizing project risks and ensuring efficient resource utilization.